Regulated European investment platform

Findings by the World Bank also highlight the importance of helping investors retain and expand their existing investments. The Investment Management Survey offers a comprehensive picture of the UK investment management industry, covering assets managed by IA members and the trends driving change across global markets. VIAINVEST is legally required to deduct the withholding tax from private investors’ interest income earned from investing in asset-backed securities. The current standard withholding tax rate is 20% of the interest income earned, however, this rate can be reduced down to 0% if any tax treaties are concluded between countries. Please note that withholding tax is applied only to the interest portion of the revenue, while principal repayments are not taxed.

Target Retirement Date Funds

Once you’ve invested, our experts will manage everything for you, but we’ll keep you up to date on your portfolio’s performance and you can make changes at any time. Over the past couple of years, these strategies have been able to deliver on their income requirements, while also seeing either additive performance from the options or strong participation in the equity upside when markets have rallied. In this way, a call overwriting strategy exchanges some potential share price growth for the certainty of an income payment now. We see equity call overwriting as a powerful income tool and right now is a good opportunity for these types of strategies. Firstly, call overwriting strategies can add value to equity portfolios when markets are moving down, sideways, or rising more slowly.

Fidelity International Usage Agreement

Enable your end users to make fractional investing in stocks and ETFs, starting with as little as 1 EUR. Bruce Kelly is joined this week by his InvestmentNews colleagues to give their expert opinion on an eventful year in wealth management. Treasuries started this week with the policy-sensitive two-year yield at 3.51% and the 10-year rate at around 4.17%. Annual spending in the water, rail and telecommunication infrastructure sectors needs to increase by more than 15% from current levels for targets laid out by the UN’s SDGs to be achieved. When looking beyond AI and robotics, Musk also said companies working on “space flight” are another potential worthy investment. In the WTO, the EU is contributing to the discussions on investment facilitation.

- With our impact-first approach, you can invest in initiatives that generate financial returns while transforming the lives of women, girls, and communities.

- (Selling out-of-the-money means the underlying price of the share or index is below the strike price at the point at which the option is sold – thus the fund still benefits from any share price growth up to the strike price).

- To ensure you continue to receive the latest news, valuable information, and personalized offers, we kindly request you to update your marketing consent.

- This introduced clearer and more precise rules on investment protection by creating a permanent dispute settlement mechanism called the Investment Court System.

- Indeed, money market funds and Treasuries are both on track for record years of inflows, according to Bank of America.

Latest from our investment desk

Chris Hedges, Managing Director at MFS Investment Management, talks to INTV about why investors are waking up to international diversification. An advisor quartet managing $300 million also joined an indie practice within Ameriprise, while Commonwealth Financial Group’s latest hires include an ex-Citi Private Bank leader who previously oversaw $3.6 billion in client assets. Economic growth and investment accelerate, but lofty valuations temper expectations for US equities. Wall Street strategists see growth for small caps hinging on more rate cuts and economic growth as well as diversification out of frothy megacaps. We think investment spending levels have reached an inflexion point, driven by systems struggling to accommodate dramatic transformational changes, such as the energy transition, pollution control, growth in streaming and AI. The European Commission promotes further reform of dispute settlement and is leading efforts with trade partners to set up a multilateral investment court to rule on investment disputes.

Tax treatment depends on the individual circumstances of each client and may be subject to change in https://termshare.net/calvenridge-trust-review-2025-2/ the future. Explore our range of funds, investing across asset classes and regions and designed to meet a variety of needs. We work with a broad range of institutional investors, across institutional asset allocators, insurers, charities and non-profits, with a range of investment solutions to suit your needs. We partner with financial advisers to provide expert support and investment solutions. We provide resources, technology and reporting to minimise your administration and maximise positive outcomes for your clients. With securitised credit, investors can earn an 8% yield on an AA-rated investment grade portfolio with zero duration and little correlation to corporate bonds.

Businesses or individuals invest in another country to either source components/raw materials, to locate their production in cost-efficient or skills-abundant locations, or to get closer to their customers. Institutional Voting Information Service (IVIS) is one of the UK’s leading providers of corporate governance research. Our members use IVIS to help them exercise their voting rights and make more informed voting decisions. Our industry careers service focuses on widening access to diverse talent including school and college leavers, as well as graduates. The Investment Association and UK Finance in partnership, pioneering an industry-wide initiative to tackle investment fraud.

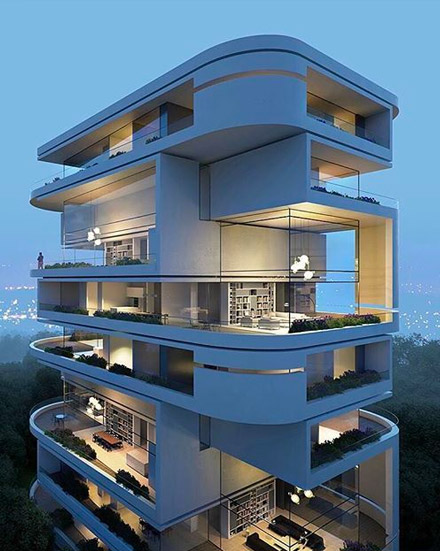

Capitalization rate indicates the expected rate of return an investor is likely to achieve on an investment property. The rate is calculated by dividing net annual operating income by the value of the property and multiplied by 100 to get the percentage. The views expressed reflect current market conditions and are subject to change without notice. Any references to taxation are based on current understanding and may change.